So far I received only one sound piece of criticism, by the financial economist Gur Huberman. Just as a painting has a utility to a collector, akin to a consumer good, bitcoin has utility for… fraudsters.

This is indeed correct but somehow it still doesn’t make much difference. Why? Because, it is turning out, bitcoin is way too transparent for a real fraudster to escape end-point busting. And, indeed, other cryptocurrencies such as monero may do a better job. And this service must be temporary, as in the traditional tug of war between cops and thieves. Consider that if bitcoin becomes a currency just for thieves, it will have no utility… for thieves. So yes, Gur is correct and bitcoin is worth something more than zero. But such a value is residual and must reach zero soon.

And of course I got a lot of junk arguments.

Junk Arguments

Ricardo Perez Marco would not have been discussed here had he not acted in bad faith. He is a professional mathematician we hired at #RWRI to discuss bitcoin, which we were trying to undersdand. He subsequently stabbed us in the back, as he turned on us, offended that we subsequently made negative public comments about bitcoin, which to him, is perfection. Yet nothing negative about him was said: it was just about bitcoin. (Note that in a long finance career I’ve never seen anyone offended that some other trader is bullish on something when he or she is short it. Never ).

I’ve seen religious fundamentalists less offended by the desecration of their gods. He has, of course, posted series of comments on the paper.

Perez Marco is another example of the professional abstract mathematician incapable of grasping elementary (I mean really elementary) financial concepts, let alone basic logical elements from the real world, and not realizing it. These poseurs very often fail to assimilate simple financial equations and relationships that truck drivers get instantly; they get arbitraged quickly, and picked on without even realizing it.

As I keep writing in the Incerto, people in quantitative finance (and economics) are extremely familiar with the problem –we avoid hiring “theorems and lemma people”, particularly those with a sense of entitlement, prefering empirically rigorous persons who can do solid math without drowning in it. It would be like asking bookkeepers for trading advice! (Simon from Renaissance is perhaps the only exception.) Perez-Marco, as math-poseur, wrote about Satoshi Nakamoto, the alleged author of the original white paper, who made a minor mistake: “He is smart but he is not a mathematician”. If I had $1 every time I spotted a mathematician making an elementary mathematical mistake in finance and probability …

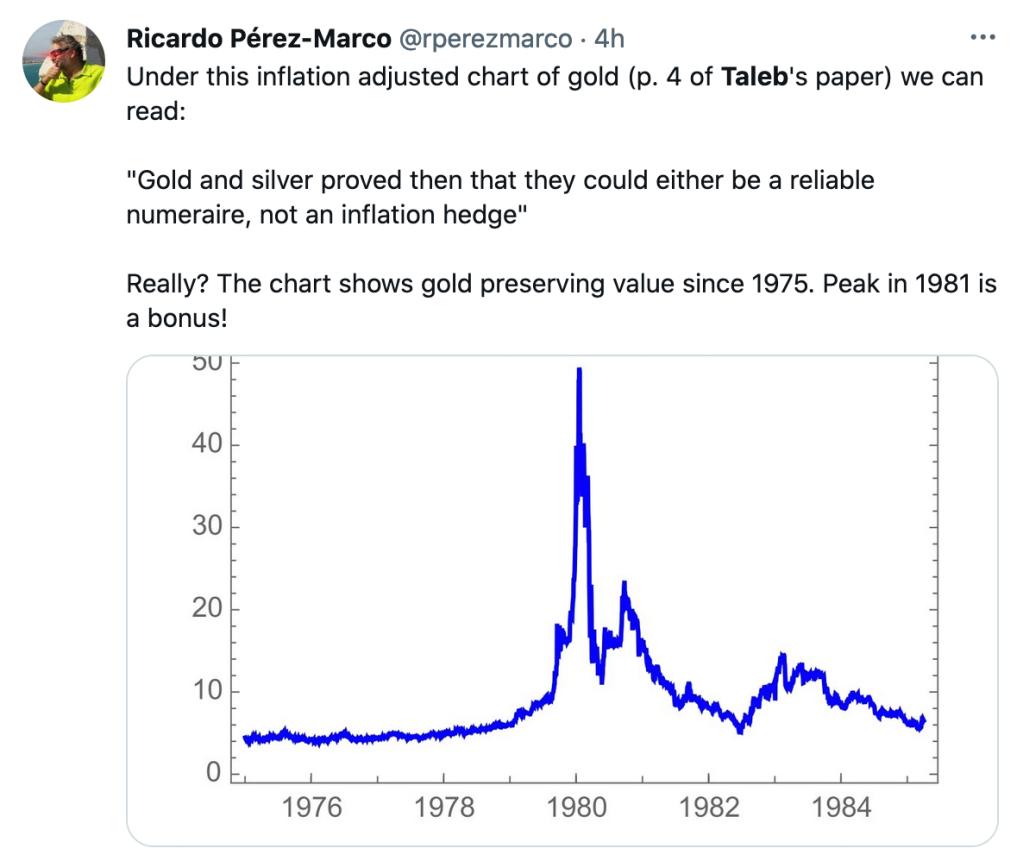

For instance, Perez Marco proved incapable to comprehend that if you can buy goods in the supermarket using a bitcoin credit card, it doesn’t mean that a price is denominated in bitcoin (denomination entails a liability). Nor did he grasp the economic notion of substitution applied to electricity uses. Now in his “rebuttals”, he still doesn’t get it; he has compared bitcoin to the CHF, when the CHF is used… as a currency by millions people transacting in it daily, in prices denominated in it, while there are no goods and services denominated in #BTC. Nor can he get some basic assumptions concerning the real world in the specification of financial dynamics. Nor does he understand hazard models.

Perez-Marco keeps saying the math is “wrong”, every time on something different. So far, no meat.

A Subplot

I’ve left Perez Marco alone to do his barking for a few months, given the #RWRI link, but he crossed the line at some point into abject behavior, by dissing #RWRI and promoting lies. And he invoked the hatred Paul Malliavin had for me, as witnessed by the following episode. Malliavin got angry, on the eve of the 2007-8 crash, that a mere trader would criticize the models that he, a member of the French Academy of Science, was defending. He died right after that and I removed his name out of respect for the recently dead.

Eggregious behavior: Perez-Marco blocked me on Twitter (again solely for disliking bitcoin). Then he tried to reach me privately to warn me against going to a competing crypto conference on grounds that someone “was a fraud” (according to bitcoiners’ mob rule, not any court of law). They don’t want me to go the competitor’s conference but do not invite me to their own conference! For nobody invited me to address the #BTC conference running at about the same time (though one of the protagonists Michael Saylor has been formally accused of fraud by the SEC). And it did not hit him to apologize for the mob harassment that his group has been subjecting me to (close to 16,000 trolls).

Selgin

Cato’s institute George Selgin said a looooot of vague things (with some erroneous financial reasoning ) but has not said anything about the paper.